Moving the difficulties of property taxes can be challenging, especially with developing regulations and delicate calculations. For investors , rental property tax software , or real estate experts, remaining on top of tax needs is not just essential in order to avoid penalties but also to maximise profitability. Listed here is wherever leveraging modern technology can improve your initiatives and eliminate economic stress.

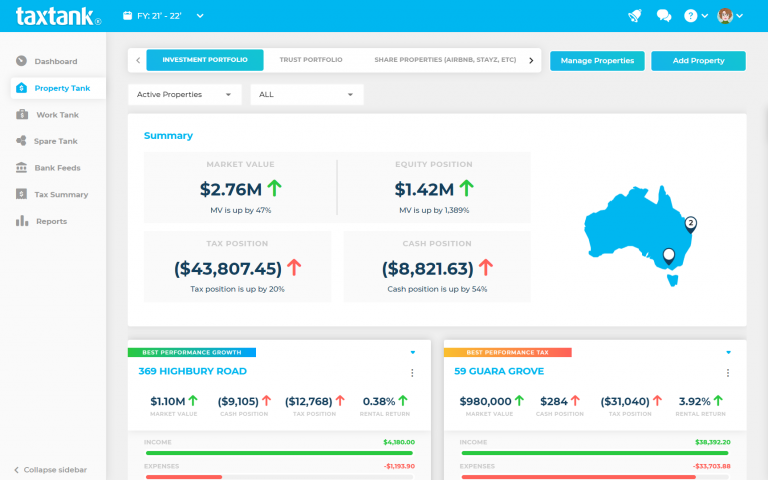

Real estate tax software is more than a digital software; it is a game-changer for arranging, calculating, and filing your fees seamlessly. By automating repetitive processes and giving designed functions, the proper software empowers customers to control their finances with precision.

The Importance of Real Estate Tax Software

Correct tax reporting is non-negotiable in true estate. From mortgage deductions to advantage depreciation, lacking out on these possibilities can significantly affect your bottom line. Tax pc software made particularly for property centers on these complexities, ensuring you claim what's actually yours while keeping compliant with tax laws.

Studies reveal that applying tax computer software can reduce problems by over 30% compared to handbook filing. This is because these applications are designed with algorithmic detail, giving regular and error-free calculations. Additionally, developing automation in to your economic workflow preserves a lot of time that would otherwise be used poring over types and receipts.

Key Features to Look for in Top Real Estate Tax Solutions

When choosing the right tax pc software to simplify your finances, prioritize characteristics that focus on true estate-specific needs. Opt for solutions that provide income and cost monitoring for your houses, automated depreciation calculations, and the ability to create comprehensive tax reports. These functionalities guarantee you have a holistic view of one's finances at any moment.

Cloud-based entry is another important factor, particularly in the current energetic qualified landscape. Having protected, mobile-friendly tax software allows you view and upgrade economic documents wherever you are, ensuring last-minute improvements or additions never catch you down guard.

Simplifying Tax Season

Late filings, overlooked deductions, and unexpected penalties often affect real-estate specialists who opt to deal with fees manually. By adopting tax computer software, you obtain satisfaction knowing your filings are appropriate and accurate. Also, several modern tools include right with sales systems, lowering unnecessary data access and the chance of oversights.

Simplifying your finances and improving tax precision isn't just attractive; it's becoming important in an industry where efficiency translates straight to profitability. Equip yourself with the proper methods and get demand of your property tax obligations effortlessly.