Handling real estate taxes can frequently sense frustrating, with complicated calculations, moving regulations, and the continuous pressure to reduce liabilities. But in today's digital age , property tax computer software is emerging as a strong tool to simply help house homeowners, investors, and corporations improve rental property tax software while keeping money.

Why Real Estate Tax Software is a Game-Changer

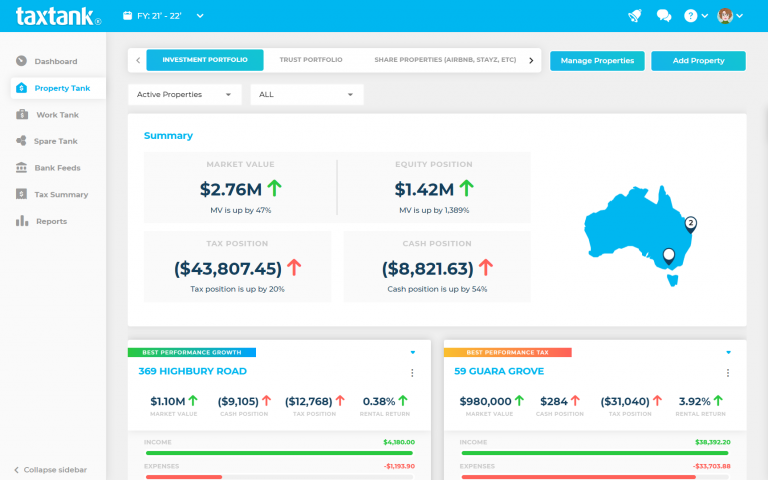

Recent statistics spotlight the significant economic benefits of leveraging advanced engineering for tax management. Based on surveys, firms that undertake computerized tax solutions report up to a 20% decrease in planning and filing errors. These errors not only charge time but usually result in penalties that has been avoided. By eliminating manual functions and human errors, real-estate tax computer software assures greater precision and compliance.

Moreover, home homeowners can improve deductions and discover missed possibilities for savings. Many programs now use sophisticated calculations to quickly identify and label deductible expenses, such as for example depreciation, maintenance charges, and fascination payments. With tax auditors quoting incomplete or wrong deductions among the prime factors for audits, the ability to boost accuracy becomes invaluable.

Key Benefits of Using Real Estate Tax Software

Among the most impressive options that come with contemporary tax software is its ability to include with present systems. Whether handling multiple properties or a single hire system, customers can simply track money, expenses, and duty liabilities in real-time. Automatic reporting features further inspire customers by providing clear ideas within their tax condition, allowing proactive preparing in front of tax season.

Still another critical advantage is staying up-to-date with moving tax regulations. Regulations surrounding real-estate fees are continually growing, and lacking key revisions can result in costly submission issues. Tax application companies often update their tools instantly to reflect the latest principles and tax limitations, ensuring that customers remain informed and compliant.

Concurrently, when it comes to audits, having organized and readily available paperwork is crucial. Real estate tax pc software assists maintain centralized documents, eliminating the severe last-minute struggle for statements or documentation.

Take Control of Your Tax Strategy

Property tax application offers a lot more than convenience; it presents users an important edge in optimizing savings, raising submission, and simplifying the frustrating job of tax management. By adopting this cutting-edge engineering, property homeowners and businesses can give attention to development while leaving the burden of calculations and compliance to a reliable, computerized system.